Arizona is a hot spot for people looking to buy a house. The state has the second-highest rate of homeownership in the country, with two-thirds of homes being owner-occupied. It also ranks near the top when it comes to home price growth, so if you're considering selling your house, now may be a perfect time!

For those homeowners who are selling their house for the first time, the task may seem daunting. However, regardless of the state you live in, there's a lengthy process you must go through before you can enjoy the proceeds from the sale of your house.

Keep on reading to learn more about the options you have, the costs involved, your responsibilities as a seller, and the sales process will be extensively explained.

If you're thinking about selling your house, there are a few initial decisions to make before you dive in. The first is determining whether you want to sell the home yourself or with a realtor.

If you're going to sell it on your own, be prepared to devote at least 80% of your daily time to dealing exclusively with the selling process. If you plan to work with a realtor, it will involve additional costs, but you will get to hand off many tasks to them.

What are the benefits and disadvantages of working with a real estate agent versus selling a house on your own? Let's look at the pros and cons of each option.

Pros

Save realty commission - The main reason people choose to sell a house on their own also called the 'FSBO' method (for sale by owner), is to save as much money as possible. Given that the seller will have to pay certain taxes anyway before completing the deal successfully, the real estate agent commission could be a substantial additional amount for those in a tight financial situation.

Complete control over everything - By choosing the FSBO route, you'll be able to build the pricing strategy yourself, schedule meetings with potential buyers, and negotiate and analyze the offers received. This means that you'll oversee dealing with market research, competition analysis, neighborhood expertise, and any other factors that may influence the final value of the set price.

Although it sounds like a lot of work in the first place, complete control over these steps is quite reassuring for some sellers. They will often feel much safer knowing that they deal with all details from start to finish.

Advertising opportunities for Private Home Sales - You will also be the head of advertising. This means that you will oversee promoting your home and posting your listing. Luckily, there are many options for homeowners who have decided to sell their properties on their own.

You can do this through an FSBO yard sign, on Craigslist, on other websites explicitly dedicated to For Sale by Owner ads, or through a flat-fee MLS company. The internet is full of possibilities!

Cons

Commission-free is rare - And, unfortunately, Arizona is not a state where a commission is optional. Being an FSBO seller will only save you from paying the commission for a possible agent of yours, not your buyer's. That's because 87% of buyers work with an agent.

If you list FSBO and sell to a buyer without an agent (a relatively rare situation), you will pay no commission. However, if you list FSBO and sell to a represented buyer, you must cover the buyer's agent commission.

Time resources are needed - By listing FSBO, you will get into the role of a seller, negotiator, advertiser, house guide and must be responsible for all legal requirements. Acting in all these roles means that you will have to dedicate a significant amount of time to this selling.

Successful advertising is problematic - Effectively advertising a house requires the experience of a professional. If you are not a marketer, it will take some time to figure out how to promote your home in the best ways. This time spent trying to learn could involve a few hundred unsuccessful photos and poor-selling propositions.

Many homeowners do not have the necessary skills and experience to use other ways of promotion besides just posting online. Expert agents in real estate have a customer base that they can access and know exactly who to talk to, thus eliminating potential buyers who could waste time.

Practical negotiation skills are required - Reaching an agreement with a potential buyer can be intimidating. As you negotiate and eventually settle on a price, it may be challenging to defend a fair house price while also meeting the buyer's requests. Many of those requests will not even be related to the price. Instead, they'll be related to the issues identified after inspecting the house.

A home inspection is the one component that can often end the buyer's interest due to unsuccessful negotiation. This places the FSBO seller in a position where they must now look for other potential buyers.

The way you handle the negotiations after a house inspection can be a determining factor in whether you have a successful sale or not.

💡 Key Insight: Keep in mind that when negotiating home inspection items, you should always try to negotiate for a closing cost credit or a price reduction instead of going through time-consuming reparations. Or, to avoid all this, you can make sure that your house is well kept from the beginning.

Pros

More credibility - Leaving the house-selling responsibilities in the hands of a professional is typically a good idea, especially if you have zero knowledge about selling a house. And, despite the beliefs of those who prefer the DIY approach, this option can bring many benefits.

Your potential buyers will usually have an agent to represent them. If sellers also use a realtor, it will give them more credibility. The buyers and their agents know that those who embark on selling their own homes are usually inexperienced. They understand that FSBO Sellers can potentially be a waste of time trying to work with.

Thus, a represented buyer will primarily focus on represented sellers.

Expert advertising - Working with an agent means having access to a professional database of buyers who know exactly what they are looking for, high-quality photos of the properties, and well-crafted sales speeches.

Advertising your house on your means promoting it among buyers as inexperienced as you.

Deciding to work with a real estate agent will get you access to higher-level advertising. The agent will know how to raise awareness at the right target using the proper tools.

Tips for improvements - Did you know that specific improvements before meeting potential buyers can significantly increase the price of your house? Maybe you didn't, but a real estate agent certainly knows.

They will give you valuable tips on the improvements you can make to increase the selling value of your property.

💡Key Insight: The condition of your home plays a significant role in its value and appraisal - for example, a deck addition can recoup as much as 72% during resale.

Agents work full-time on the task - This means that your responsibilities will diminish significantly after hiring one. They can fully deal with market research, price strategy, home inspection, and any other aspects of the sale process.

However, that does not mean that you will no longer have control over your house being sold. Instead, you will have the freedom to get involved only when you have the time and desire to do so.

No emotions involved - When selling a house independently, it is easy to fall prey to emotions and become subjective about certain aspects of the process. The agent will pursue only one goal - to sell, so there will be no influence from other external factors.

They will aim to find the best price, carefully filter prospective buyers, negotiate to your advantage, and ensure that both sides are satisfied with the end agreement.

Avoid legal issues - Selling a house is an activity that involves following a lot of laws. Sometimes, no matter how hard you try, there is a possibility that you will lose sight of something.

Sellers must deal with legal requirements such as Arizona disclosure forms. An agent will advise you on all the documents you need to close the sale without legal complications.

Cons

Paying commission - The average commission rate in Arizona for a realtor is somewhere between 5-6% of the house price. Given that the median price in Arizona is $375,000, the commission for a realtor would reach somewhere between $18,750 - $22,500. Although it is not a colossal amount for some people, it is still quite a lot for others.

This is the main reason why many homeowners avoid hiring a realtor when selling their properties. Unfortunately, they often avoid it without considering all the effort they will have to get their home sold.

Incompatible partnership - As with many other services that people use, there are many real estate agents on the market, some experienced, some less professional.

There is always a possibility you will find an agent with whom you are not compatible. Some agents might treat you as just another one of their many clients, and they may not be efficient in fulfilling your objectives.

Choosing to either sell your house independently or with a real estate agent is an important decision. There are pros and cons of both methods, so it's best to weigh them all before making a choice.

Do you have the time and patience to sell on your own? Is it worth it to you to do the work of selling your home so you can avoid paying commission fees? Are you comfortable negotiating offers from potential buyers? Can you handle rejection without getting discouraged?

If not, then going with a real estate agent might be your best option. Realtors will do most of the work for you, devote their time to effectively marketing your property, and iron out the details when it comes time to make a settlement. You'll also have access to their knowledge about market conditions to get the best possible price.

Sellers want to sell their property as quickly and for as much money as possible. But, to achieve that, they must follow some tried-and-tested steps towards the sale.

Whether you choose to sell your home on your own or work with a real estate agent, both options typically follow the same selling process.

The best way to set your home's price is first to compare it with similar properties. Check the price for homes like yours which have been sold in recent months. You can also keep an eye on local real estate listings and see what costs the homes are sold for.

However, pricing a home is an essential skill for a real estate agent. Pricing your house too high will make it harder for people to find it desirable, while pricing it too low will make you miss out on potential income. If you choose to work with a realtor, determining the selling price will be much less of a concern for you.

The timing of your home sale can also impact its price, so keep in mind when the best times are for selling homes, specifically in Arizona.

💡 Key Insight: If a fast sale is your goal, you should list in June and July as these are the months with the quickest sale rate in Arizona.

Success in real estate can depend a lot on marketing. A good marketing plan for your home will yield the best results and get you to close the deal quicker.

As a homeowner, you may have heard that advertising is essential when selling your house. It can be challenging to know where and how to advertise your property for sale without hiring a professional. Real estate agents are trained to know the best ways to promote and bring potential buyers into their listings.

But if you're looking for an alternative way, many online resources will get the word out about your listing as well as provide other helpful information on the home buying process.

Although choosing to work with an agent is an optional step, advertising your property is mandatory.

Next comes the step where potential buyers will visit the property for an inspection. You can present the house to them, or you can delegate this responsibility to the real estate agent.

The buyers will usually want to check if the pictures match the reality of the home, see what they can do with space, and see how it appeals to them. Therefore, you must make sure your house looks its best when showing it.

Some ways you could prepare before a showing include:

Most buyers will want to negotiate when it comes to the final price. The negotiation includes closing costs, transfer taxes, inspection fees, and other fees associated with the close. You will either prepare for this negotiation or choose to have an agent negotiate on your behalf.

Before finalizing a purchase, a home inspection and an appraisal done by a licensed Arizona appraiser need to be completed.

Some may be surprised to learn there is a difference between home inspections and appraisals, because they are so often used interchangeably. In reality, however, they are extremely different in terms of the purpose they serve and the clients they service. The Home inspection is done on your behalf, while the appraisal is done on behalf of the bank holding the mortgage (to preserve their interests in the transaction).

A home inspector will thoroughly inspect the property for any issues that may be present and make recommendations to fix them.

This appraisal is necessary to get an idea of what your home is worth in the current market. You will also need to register your property with the county and pay a $5 fee. In addition, you will need to provide information about your property that includes when you moved in, when you built it, how many bedrooms are included, and more.

This final step follows the same process as other states. However, there are some unique aspects of the closing process in Arizona that may cause some confusion to buyers and sellers alike.

The closing can span over a few days or up to a week. In the state of Arizona, not all parties are required to be present to finalize the closing of a sale.

Before you can finalize the sale, the buyer must also pay any remaining balance in down payment and any other costs owed to the seller. After that, the buyer receives the keys, and the house is officially sold.

The Arizona Real Estate Disclosure Law requires sellers of real property to provide a disclosure document disclosing information about any defects in the property. The law applies to all residential real estate transactions regardless of whether it's a single-family home, condominium, townhome, or manufactured home.

For your house to pass inspection and be sold on the market, you have to comply with this law by giving buyers one of two documents: a Home Sellers' Disclosure Statement(SPDS) or a Custom Residential Property Report (CRPR). These include questions for the seller related to all essential facts known about the house to inform the buyers about the property's condition.

💡 Key Insight: The SPDS is divided into several detailed categories such as ownership and property, the safety level of the house, sewer/wastewater treatment, utilities and services, and other conditions and factors regarding the environment.

However, even if this document aims to get many answers about the property for sale, there are a few things that the seller isn't legally required to disclose, such as:

We go more into depth in our article Real Estate Disclosures – What You Have to Share Legally in Phoenix

Selling a home in Arizona is no easy task. You must put yourself out there and be willing to work hard to reach your goal of a successful sale. It can be even more challenging when you are also trying to balance work and personal life simultaneously. Fortunately, if you're considering selling your house soon, working with a professional can make the process much easier and less stressful.

The Trusted Home Buyer will help guide you through the entire sales process from start to finish. We ensure that all your needs are met without any stress or pressure on your part, and there are no hidden fees involved.

We know how tough things can be when people try doing everything themselves, which is why we're here to lighten the load by taking over all your seller responsibilities.

Let's say that your house is in poor condition, and you don't have the money, time, or energy to make the required repairs needed to get your home sold. Realtors often struggle to sell distressed homes, and unless you are a professional in the real estate space, selling an FSBO distressed house is not recommended. Buyers will use the condition of your house to knock the price down much lower than what you could get by selling to a cash home buyer such as us!

👍 Sell to Us: We have an excellent track record with our clients. Don't just take our word for it and check out our reviews here. You might be thinking to yourself, "Cash Home Buyers are Scammers." Read our article on what constitutes an honest Cash Home Buyer. You see, we want you to do your research on us before you decide to get an offer from us.------> Get your free offer today!

Closing costs in Arizona vary based on several factors, such as type of mortgage, real estate concessions, and other fees. While some of them are fixed, others can be negotiated/lowered depending on the situation.

Those costs typically include title insurance, appraisal fee, recording fee, homeowner's association transfer fee, fender's title insurance policy, lender's settlement charge, lender's discount for automated underwriting systems, government recording charges, and miscellaneous escrow fees.

When you sell your home in Arizona FSBO, there is no protection if the buyer doesn't follow through with the purchase. The most important protection you can get is to have a real estate lawyer review the contract before signing.

You should always consult an attorney to learn more about the seller's disclosure requirements in the state before making a selling decision on your property.

Seller property disclosures are required by law in Arizona. The seller is obligated to provide these disclosures to the buyer.

Sellers who skip disclosure could be sanctioned by law, given that buyers may find an issue in the house after the purchase about which they were not informed from the beginning

After the two parties agree to the terms, some formalities are involved. One such formality is a Purchase Agreement, which is a contract between the seller and buyer. It can be used to sell just about any kind of property, including land, houses, condominiums, commercial buildings, vacant lots, or undeveloped property.

The following vital sections would typically be included within this agreement:

- The offer price and amount of earnest money.

- Other conditions must be met before the sale can conclude.

- When and how the purchase price will be paid to the seller.

- The date on which the title will transfer from seller to buyer.

- Any other conditions related to the sale or moving in after closing (e.g., utilities).

A Guest Post From OasisAdvisor

When it comes to such an important aspect in your life or the life of a senior you know and love, you want a trusted advisor to guide you every step of the way. Being proactive and planning is the best approach.

We want you to know that we understand firsthand how difficult these transitions can be and the decisions that come with them. It is important to keep in mind there are many aspects to consider when discussing senior care options, including physical, financial, mental, social, and emotional aspects of this time.

Some of the signs that you, or a senior you love, may need to consider additional help to remain in their home, move into a residential care home, or transition into an independent, assisted, or memory care living space are listed below.

If you find that your loved one needs senior care, Oasis Senior Advisors of Scottsdale can help you with your placement needs and serve as a trusted source of referral partners.

We go above and beyond for our clients, offering you complimentary, one-on-one, face-to-face, compassionate, personalized service in our local community utilizing our proprietary OasisIQ software to find the best fit for you.

We Make Finding Senior Housing Options Simple!

Nancy Pol | 480-601-1083 | JNPol@YourOasisAdvisor.com www.oasissenioradvisors.com/Scottsdale

Having an exclusive contract with a real estate agent leads to numerous benefits, some expected and perhaps even unexpected. However, when a real estate agent asks you to sign an exclusive contract with him or her, he or she is also getting something from it – so there are also some additional costs. Continue reading about both the costs and benefits and how they can hinder or benefit your home search.

In order to understand why a why a real estate agent may want you to sign an exclusive contract, just imagine the scenario:

"Finally, after tons and tons of work, your client, the buyer makes an offer for the home they wish to purchase, and you as the real estate agent could not be happier – not only have you helped your client, but also made some income.

However, there is a little bump in the road – the offer is made with a different agent. It turns out that the buyer's friend at church is also an agent and the buyer submits their offer through her instead."

In this case, the original agent will wish they had made the buyer sign the “buyer agreement” - an exclusive contract that would not allow the buyer to make a offer with a different real estate agent.

Unfortunately, however, this scenario can also work in reverse – the real estate agent may drop the client, in which case the client is not only left without an offer but without any help to make one!

Luckily for the buyer, this scenario is much less likely – most real estate agents work on commission; thus, their income comes primarily from getting the buyer a successful and finalized deal.

💡Key Insight: An exclusive contract protects both parties-the buyer and the buyers real estate agent.

In a similar way that listing agents sign an exclusive listing agreement with the seller, a similar option exists with a buyer’s broker agreement.

As a buyer, it may not seem to make much sense initially to sign an exclusive contract with one agent. However, it is essential to keep in mind you will be working with the agent for an extensive period of time –a good agent will invest an enormous amount of effort and time in helping their client to become properly positioned so that when you find your dream home, that your offer will be accepted.

This effort can include things like introductions to lenders, advice on the finding the best subdivision or area to buy for your needs, advice on how to present your finances when making an offer so the seller will like your offer better than the others, setting up their portal so you get emails and updates on the areas of interest, etc.

This process can be anywhere from several weeks to several months of “up front” work on the part of the agent. Consequently, it may be in your best interests to enter into an exclusive contract with your agent,since that commitment allows your agent to justify spending that extra time and effort with you, and prioritizing your needs above other less committed potential clients who are not willing to commit. The agreement will incentivize the agent.

An agent usually works with the buyer for several weeks, or in some cases even several months. In his job, the real estate agent should make sufficient effort to include the buyer – from introducing the buyer to lenders and helping them get their loan approved to introducing them to their future home and helping them make the home theirs.

This will include endless emails full of home offerings that fit the buyer’s requirements, to various appointments and finally showings, often driving the buyer from one neighborhood to the next. Because of the sheer amount of work involved, a contract can be incredibly helpful – it can outline the rights and responsibilities of both parties for their best interests.

And if the agent is not serving the buyer sufficiently, the buyer always has the right to end the contract and fire the real estate agent. However, as this is a bilateral contract, both parties must agree to the relationship's ending.

💡Key Insight: An exclusive contract with a real estate agent can help set the terms for both parties-which is incredibly useful

A buyer’s broker agreement, or in other words a buyer-broken contract, is, first of all, a form of contract – thus a legal, typically bilateral agreement between two parties. The contract outlines both the rights and requirements for both the buyer and the real estate agent.

The agent’s responsibilities are most likely to include activities such as locating and identifying potential properties for the buyer to consider, reviewing paperwork, preparing purchase offers, and might also include some other additional services – this depends solely on what both the real estate agent and the buyer agree to.

The buyer’s requirements are obviously much smaller – usually, they include them having to seriously consider the home offerings, qualifying to purchase the property, reading all the materials provided, and perhaps most importantly, cooperating with the real estate agent.

For many buyer-seller relationships, this arrangement is ideal – the contract with the real estate agent ensures the things run smoothly, and both the buyer and the seller gain maximal satisfaction from their purchase and sale, respectively.

💡Key Insight: An exclusive buyer’s broker agreement puts into writing what the real estate agent is responsible for and what the buyers responsibilities are

According to the details stated in the contract, the broker or the real estate agent will receive their commission on the property at the time of closing, or in other words, when the sale of the home is finalized.

As such, the commission works in the same way as they would without an agreement. However, there is one minor change – if a hardworking agent has a buyer attempting to flake on the agreement or the sale, and they are trying to purchase a contract with another broker, the real estate agent may still be entitled to their compensation.

And as such, even though the sale of the house may not go through, the buyer may still be required to pay the real estate agent their commission.

It is important to keep in mind that some real estate agents will not even ask the buyer to sign the exclusive contract with them – in which case, it may be solely on the buyer to decide.

However, if the buyer does decide to sign, it is important to keep in mind a few things. Firstly, the agreement usually lasts 90 days, and even though the buyer is allowed to ask for a shorter term of 30 or even fewer days, real estate agents will often refuse.

This is mainly because the agent risks putting the buyer on the right path to finding a potential buyer and then being fired before achieving their sale commission. The buyer is also not allowed to ask another broker to show the home or property.

The buyer can, however, still buy without an agent. It does have its disadvantage – the real estate agent is still entitled to their commission, even if the sale was achieved without their help. If any disputes arise, they can be brought to the small claims court. Essentially, the contract represents an exclusive right for the agent to gain their commission if they have succeeded in their work.

Additionally, keep in mind these contracts tend to be largely bilateral – meaning that both the real estate agent and the buyer must agree to end the contract while it is still active. One party cannot simply leave the other without the second party’s consent.

💡Key Insight: Top risks for the home seller: locked into a 90 Day contract. The agent is still eligible for a commission if a buyer buys a house without their help. Also, the contract is bilateral: one party can't leave the contract without the permission of the other parties consent

The short answer is – yes, but... Apart from the already mentioned way, whereby both parties agree to end the contract prematurely, there are also other ways to end the contract without paying the agent the commission they may feel entitled to.

This way can only work if the contract has not been signed yet, and will only work with certain agencies or brokers. Essentially, the buyer can ask the broker to place a guarantee request in terms of the contract. This means that in certain cases, it is guaranteed that the buyer can leave without any penalties.

The circumstances of this depend on what both the real estate agent and the buyer agree to. However, in most cases, these can include reasons such as the agent and the buyer not being a good fit, the agent under delivering on the buyer's requests, and others.

It is crucial to know that the buyer does indeed have the right to request this addition to the contract and should place it if possible – just in case. However, it is also essential to keep in mind that many brokers will not allow for the guarantee request, as it may be too risky for them – the client can claim they are not a good fit at any point.

It may thus leave the real estate agent without their desired commission.

💡Key Insight: Before signing a contract ask to place a guarantee request on the contract.

This, although a way to end the contract, maybe a more unfortunate way for many. A sure way to end the contract is to shift the focus to another type of property fully.

If the buyer jumps ship and purchases a whole different type of property than stated in the contract, they are legally allowed to end it while not having to pay any additional charges.

For example, if the buyer intended to buy a single-family home, they are still free to change their broker and buy a different house if they choose to buy a multi-family home instead.

Other parameters mentioned within the contract are also applicable in the same way. If the contract states a certain city, the buyer wishes to buy their home in. They are free to purchase a home with any broker outside of the area stated in the contract.

Other possible parameters may include – a specific state, price range, or type of property. However, this way will be incredibly illogical for most buyers – it may not make sense to purchase a kind of home the buyer does not want or one in an area they do not wish to live in.

💡Key Insight: It is possible to break the contract by purchasing outside the agreed upon geographic parameters or if the buyer chooses to purchase an entirely different style of property.

As previously mentioned, the contracts are only active for a certain number of days after being signed – usually 90, but in certain cases, this number can be negotiated down. Because the contracts usually last a certain period, the buyer is no longer bound to the contract after the period passes. However, most real estate agents will not agree to end the contract in under 30 days.

💡Key Insight: Once the contract is over, the buyer and agent are free to do as they wish

Lastly, and perhaps most importantly, if the buyer wishes to end an exclusive buyer’s contract, he or she may best refer to the terms of the contract. Within the agreement, an area will include the details upon which the contract can be terminated. Termination should always be spelled out and may require payment or commission, as discussed above.

As discussed above, buying a home within the areas specified in the contract without the broker’s help, assistance, or with the help or assistance of another real estate agent may mean the broker is entitled to a certain fee or a commission.

Again, the details and the size of this fee will be spelled out within the contract. Thus, before the buyer violates the agreement, it is crucial that they know the sanctions that will follow. Because of this, it is always better to first have a conversation with the real estate agent and attempt to end the exclusive contract amicably.

Despite the possible disadvantages, it is essential to keep in mind the benefits. Not only does the contract provide security to both parties, but it also enlists their rights and responsibilities.

In this case, neither party can claim they were allowed/not allowed to do some activity without consequences. Essentially, if the buyer signs the agreement, they know exactly what and what not to expect – and so applies to the real estate agent.

Therefore, it is crucial to keep in mind the agreement can be largely beneficial if done correctly. As with any contract, it is crucial to read the agreement and ask any questions carefully – it is better to do so earlier than later.

It could also be preferable to take the contract draft with you and consult any real estate lawyer or professional for specifics before signing the infamous dotted line.

Additionally, it is important to get to know the real estate agent before signing the agreement. It may also be good to research the agency, read any possible reviews, and get an overall feel for whether they are not only trustworthy but whether they will also be helpful and efficient in the home-search process.

Moreover, some real estate agents may allow the buyer to place a guarantee request in the contract, thus allowing the buyer to leave the contract without a penalty in certain cases (for example, if it is not a good match or if the agent is not doing satisfactory work.)

💡Key Insight: At the end of the day the contract serves a purpose of serving both parties by providing security

Guest Post By: Jennifer Almodovar from morethanamovephx.com

Senior Move Managers are like the fairy godmothers of downsizing who can swoop in, whip your home into shape, and help you tackle daunting moves faster than you can say “bippity boppity boo.”

The prospect of downsizing and moving to a smaller home or to a senior living community can be daunting. Because of this, older adults often put off a move they’d like to make. Cleaning out the attic and packing up the shed. Figuring out which belongings to keep and which ones to donate—asking who might be interested in family heirlooms. All of this might feel overwhelming.

One solution to consider is hiring a senior move manager

Many people are unfamiliar with this group of professionals who are experienced at managing all of the details of downsizing and relocating. From supervising the movers to cleaning out the basement, they can make the transition go more smoothly. Older adults making a transition have usually not moved in 20, 30, or 40 years and need to downsize considerably. The organizational and physical tasks associated with planning and implementing such a complex move can be overwhelming for the entire family. It is best to seek the help of experienced, insured professionals.

Senior Move Management is the profession that assists older adults, individuals, and their families with the emotional and physical aspects of relocation. We have extensive, practical knowledge about the costs, quality, and availability of various local community resources. One call to More Than A Move, and we can provide you with services for a seamless, successful transition of all kinds. We work one-on-one with individuals and families to accomplish the many tasks associated with moving.

Move managers can help in a variety of ways to simplify and destress the moving process.

Our team has significant expertise and resources to save you money, reduce stress, and produce quality results. We personalize our services to meet your unique needs and preferences, and we also work to continue our education to stay up to date on the best ways to serve our clients.

We are a NASMM member, and our company is reviewed for insurance. We are required to take Cornerstone Courses, focusing on core competencies in Senior Move Management®, including Ethics & Accountability, Safety, Understanding the Moving Industry & Understanding Contracts & Liability.

Our team is dedicated to ongoing educational programs that reflect the NASMM's commitment to professionalism and working with older adults, families, and others. More Than A Move has completed and earned the certificate SMM-C to be a certified Senior Move and Specialty Manager.

To connect with More Than a Move:

480-993-6440

morethanamovellc@gmail.com

Are you considering the purchase of a new home in the sun-drenched state of Arizona but feeling unsure about where to begin? Moving to a different state or area often entails additional research and insider knowledge. Fortunately, you're in luck because we have both of those covered. Read on to discover comprehensive information about the cost of buying a home in Arizona and essential details you need to know about the state's real estate market.

While housing prices vary depending on the specific location, the median price for homes in Arizona in 2021 was approximately $350,000. This figure represents an increase of about 12.7% compared to the previous year when the average median price was around $309,000. Although the rate of increase is expected to slow down, a significant decline in prices is unlikely. Therefore, anticipate a continued steady rise in housing prices throughout the year, albeit at a slower pace.

While this list provides a snapshot of affordable places to live in Arizona, it's important to note that the real estate market is constantly evolving. Additionally, honorable mentions go to Litchfield Park and Prescott for offering affordable homes.

Determining the best place to live in Arizona is a personal choice that depends on various factors, including personal preferences and priorities. However, if you consider crime statistics as a significant factor in your decision-making process, it's advisable to exercise caution when considering areas such as Kingman, Avra Valley, Holbrook, Snowflake, and Coolidge. These areas have been identified as having higher crime rates compared to other parts of the state.

In addition to crime statistics, you should also take into account other factors when choosing a place to live in Arizona, including housing costs, the overall cost of living, school ratings, available amenities, preferred lifestyle, and average income levels. These considerations will help you make an informed decision that aligns with your needs and preferences.

It's worth mentioning that while gathering information and conducting research is essential, it's also recommended to spend time in the area you're considering to get a firsthand experience of the community and environment. Visiting the prospective neighborhood for a few days can provide valuable insights and help determine whether it's the right fit for you and your family.

In 2023, it's unlikely that housing prices in Arizona will experience a significant decrease. The state continues to attract a steady influx of new residents, while the availability of homes remains limited. These factors contribute to a sustained demand that keeps the real estate market relatively stable.

Although concerns about a housing bubble have been raised, experts do not foresee such a scenario occurring in the near future. Factors such as forbearance options, equity cushions, and stricter upfront mortgage lending practices contribute to the market's resilience, minimizing the likelihood of a crash.

While the rate of price increases may slow down, it's important to note that the current market conditions may not be sustainable in the long term. Therefore, it's crucial for potential buyers to consider their long-term financial goals and carefully evaluate the affordability and stability of their desired housing options.

If you find yourself needing to sell your Arizona home in order to relocate to a new location, The Trusted Home Buyer is here to assist you. We offer unique solutions for home buying and ensure that you receive a fair cash price for your property.

Recognizing that moving can be a complex process, we provide flexible closing dates and never charge any fees, allowing for a smooth and hassle-free experience.

Selling your home in Arizona can be a daunting task, but with the help of experienced professionals, you can navigate the process with confidence and peace of mind.

Contact The Trusted Home Buyer today to discuss your needs and explore the options available to you.

While many have come to love Arizona for its phenomenal weather, the housing market is also a popular attribute of living in this sunny state. However, as with any housing market, Arizona can be complicated primarily because of its harsh summers. So, if you need some insight and tips for the best times to invest in a new house in Arizona and when is the best time to buy a house in Arizona while also understanding how to handle its housing estate climate, keep reading!

Firstly, you need to understand what market you’re dealing with to understand how to get the best deals – and at what time. For example, the Arizona property market is a seller’s market. This means more buyers are interested in the property than the number of sellers offering it.

And what does this mean for you? Well, it means the sellers have the upper hand; and can dictate the price.

This also means that the higher the number of houses being sold, the lower the price is likely to be – as there is less buyer interest per house.

Therefore, despite there being times when the interest in buying housing outstrips the available supply, resulting in higher prices in a particular region, there are times when there is less demand and more houses on the market–this is the time to buy!

💡Key Insight: Seller's market in real estate refers to more buyers on the market than the available inventory--ultimately this mans the perceived value is higher

As we mentioned earlier, the housing market is a seller’s market, but there are also fluctuations between supply and demand. Because of this, you can identify a ‘seasonal pattern’ in the market when you’ll find you don’t have as much competition from the average home buyer.

As the summer tends to be the busiest moving time for most people, mainly due to school starting in August/September, the demand for houses is usually much higher in the summer, which means there are fewer houses to choose from per buyer.

Additionally, people usually prefer to avoid the hassle of moving in summer due to the weather inconvenience and time inconvenience (if you have kids). This means this is the perfect low-demand period to buy a house at a much lower price than the annual average.

During this time, sellers tend to get fewer offers on their houses, so most are willing to negotiate, giving you the upper hand on the price you pay.

💡Key Insight: Arizona has a different climate then the rest of the United States and results in a varied market conditions in relation to the weather.

💡Key Insight: Buy when everybody is selling. Sounds easy but in practice is quite difficult. Monitor the market in advance to purchasing your Arizona home. Check out the historical data of the previous years

To examine the market a little better, let us first look at the national statistics over a period of 6 years. Then, ATTOM Data Solutions, the curator of the nation’s premier property database and first property data provider of Data-as-a-Service (DaaS), revealed its analysis which shows that really only 3 days of the year offer discounts below estimated market value — all falling in December.

This analysis includes data on more than 23 million single-family home and condo sales over 6 years from 2013 to 2019 and shows the continuation of what is referred to as the ‘hot seller’s market.’

| Month | Day | # of Sales | Median Price | Median AVM | Premium/Discount |

| Dec. | 26 | 36,102 | $195,500 | $196,000 | -0.3% |

| Dec. | 31 | 64,515 | $190,000 | $ 190,270 | -0.1% |

| Dec. | 4 | 73,064 | $195,000 | $195,151 | -0.1% |

ATTOM Data Solutions examined all calendar days between the years 2013 and 2019, considering the prices of at least 10,000 single-family home and condo sales.

To calculate the premium or discount paid on a given day, ATTOM compared the median sales price for homes with a purchase closing on that day with the median automated valuation model (AVM) for those same homes at the time of sale.

However, this calculation is for the US as a whole, not just Arizona. So let’s look at the data for Arizona in particular as, as we all know, Arizona sometimes tends to be a little different.

💡Key Insight: While the data for the entire housing market of the US reflect that selling your house in December will bring you the most money; Arizona is a different case

When it comes to buying any house, many will acknowledge that it can be a long and stressful process, possibly full of emotions and full of touring properties and filling out hundreds of forms. After all, you are likely to spend a lot of your savings; for the vast majority, it will be their most significant investment.

You need to have enough data – especially when it comes to Arizona's market, which tends to fluctuate vastly.

For example, the listing prices in 2020 have been the lowest in May so far, and $38,319 less expensive than the year average.

The highest prices were in November – $41,822 more than the annual average.

However, it is essential to note that prices tend to fluctuate year to year, and in previous years, December was the best time to buy a house, not only in Arizona but nationally.

It is also important to remember that everyone’s priorities and situation are different – but we have included a table accounting precisely for that.

| Listing price | May | 6.2% lower than average |

| Housing inventory | April | 34.4% more homes to choose from |

| Mortgage rates | December | 2.92% interest for 30-yr mortgage |

Compared with the rest of the US, where the best time to buy a new house tends to be around spring or winter, it is much better to buy a house during winter in Arizona. This is mainly due to the harsh summers and mild winters experienced in the state.

Due to the hot weather, summer can be a time for bargain-hunting in the housing market.

While most of the US sees fewer homes on the market and rock-bottom prices in the dead of winter, Arizona saw these in the heat of summer last year.

However, suppose you’re looking for variety. In that case, you’ll find more house variety during the January and February months, as the sellers hope to attract those who do not particularly like the cold winters in other states (snowbirds). Because of this, the market tends to be busiest between late fall to early spring.

💡Key Insight: Summer can be a good time to bargain hunt in Arizona. However, if you are looking for variety then consider January--February. Spring to Fall are the busiest times of the year.

One thing to note is that summer is the most expensive time to buy (nationwide). However, statistics show that December, January, and February represent lower price points than June and August.

Therefore, you will likely stumble upon many articles telling you January is prime buying time. However, as with many other things, Arizona’s rules are a little different.

The best time to buy in Arizona is during the summer if you are price sensitive. Locals tend to flee elsewhere to find colder temperatures, with the Arizona heat peaking at around 120 degrees Fahrenheit. And with that, fewer buyers are in the market, creating the best conditions to get the cheapest deals possible.

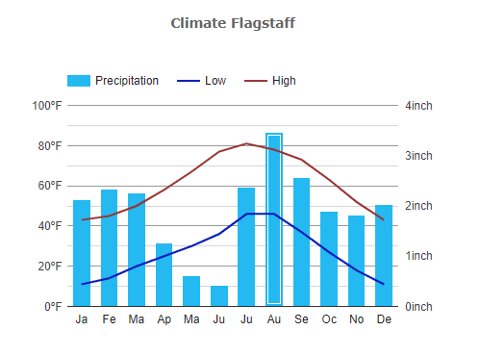

However, this may only be true across some of Arizona Flagstaff and Sedona, the two of the northernmost parts of Arizona, do not get nearly as warm during the summer months, with mild temperatures around 80 degrees Fahrenheit in August.

💡Key Insight: Finding cheap prices in the summer is easier in Arizona, however, this doesn't apply to cooler places like Flagstaff and Sedona

Take into account that interest rates are down in case you need to take out a loan or until cheaper deals are going on. And as buying a new house is a big investment, you want to ensure that the house is good and that the rate you’re paying for the home is ideal. This means you should also consider the economic season the house is being bought in.

While December 2018 – January 2019 were marked by steady increases in mortgage interest rates, at the end of February, the interest rates spiked nationally. However, you have to remember that even a 0.5% change is significant, as this interest rate is likely to be paid over a period of around 15 to 30 years. And depending on the size of the mortgage loan, a yearly repayment is expected to be about $50,000 or more.

💡Key Insight: Take into consideration of the interest rates. Even the difference of 0.5% is a big jump when considering that you will be paying it off over the next 15 to 30 years.

At the moment, Arizona is a hot market as people from the United States are moving to the sunshine state. The best time to buy is really up to you and what your schedule looks like. In life, we can’t always plan everything perfectly, and our article gives a broad set of standards based on the historical market’s data.

However, if you want a cheaper house, the summer is the best time to buy in Arizona. On the other hand, if you want more flexibility and better prices, then the best time to buy a house in Arizona is in the winter.

But ultimately, it is up to you to do your due diligence because the market conditions change yearly. Certainly, the demand for houses in Arizona is greater than the supply. So start by watching Youtube videos and reading blogs from local companies with key market insights. Remember, variety will give you the best education because everybody has subjective views. Utilizing a video maker can also help you visually grasp market trends and insights as you navigate through valuable information.

What are some of the forecasts for the house market in Arizona?

As people from California maintain their mass exodus and move to Arizona, house prices will continue to rise. Zillow's studies forecast that Arizona home prices will increase 8.2% from September 2021.

Arizona has been known for strong real estate appreciation. Neighborhoodscout's data reveals that Arizona property values have increased by 128% since Quarter 1 of the year 2000. This averages to a rate of 4.15% per year. If these numbers continue, then Arizona's property values will continue to climb at a steady rate.

Guest Post from Always Best Care Senior Services

When a senior needs to move to assisted living or even to a family member's home, it can be a very stressful time. They might need to move because of health issues, the death of a partner, or the inability to afford their home. Whatever the reason, moving can be a very emotional time and should be done with care and understanding.

Here are some tips to help make a move less stressful on your loved one:

Take it slow: Don't start by packing up the entire house, instead slowly begin the process of packing and moving and never discard anything without their permission.

Make a list: Make sure you note the belongings that are most important to them and what they are willing to let go. There are some space restraints in senior care homes, so it is essential to take only what matters the most and let go of items that are not as important.

Show some grace: Many of the items in their home have memories and emotions tied to them, so never force them to throw anything away that is important to them.

Whether your senior relative is moving into assisted living or is simply downsizing into a more senior-friendly house, you should handle the entire process with care to ease stress and ensure a smooth transition for everyone involved.

Always Best Care Seniors Services has resources to help with all areas of need for your loved one including moving services:

Photo/Physical Inventory lists

If you need to sell your home in order to move a loved one to a care facility, The Trusted Home Buyer can help ease the transition with a quick closing date, fair cash offer, and no added fees or stress. We work with community partners to help support the transition and can connect you with placement agencies, insurance, and other senior care related resources.

You can always do it yourself if you have a truck and a trailer. Make sure that you trailer is up-to-date, if you need trailer parts check out Johnson Trailer parts, they have excellent hydraulic scissor hoists.

We asked Professional Insurance Services about the unique insurance needs you or your loved one might have when transitioning to senior care. Here is the unique insight they have on the subject, including the costs and coverage.

The transition to senior care living can save you money, eliminate the stress of owning a home, and improve your quality of life. But while there are many benefits, you also want to make sure your personal belongings are protected from the unexpected.

Exceptional senior living communities take care of most of your daily needs, but a sudden accident or natural disaster can undermine your quality of life even in a senior community. Having renter’s insurance is one of the best financial decisions you can make, even if you have downsized since moving.

If you are questioning if you need renter’s insurance because you no longer drive or own a home - think again. Even though you might not have big-ticket items, if everything were to disappear of yours tomorrow - how much would it cost to replace it all? Think about your clothes, laptops, books, shoes, furniture, and all the assets that help you function throughout the day. These are all things that the renter’s insurance will cover. For most, it would cost thousands of dollars to replace all the items.

Although your senior community covers many of your daily needs, most communities do not insure all the small possessions that could be lost in a natural disaster. Purchasing your own renters’ insurance will ensure that you are fully protected and give you peace of mind.

Renters insurance is very affordable. For most people, renter’s insurance costs anywhere between $10-$25 per month. There are several factors that the insurance companies take into account to determine your rate:

Renters insurance covers many different things that people are unaware of, including damages to your personal belongings from theft, fire, windstorm, hail, lightning, and vandalism. If someone were to get hurt in your home, it covers your liability. If someone falls and injuries themselves or even gets hurt by your pet, renter’s insurance will protect you. If you are unable to live in your home because of a storm, renters’ insurance will help pay for alternative living arrangements for the time being.

The Professional Insurance Strategies team will help you understand what is covered in your policy, so there are no surprises. Sometimes it is worth purchasing a slightly more expensive policy because it offers better coverage for unexpected mishaps.

Does my senior living community insurance cover my possessions and liability if something happens?

The answer is usually no. If your community furnishes your home, their insurance will cover what they own, but you will want to ensure all your possessions are insured.

My senior living community has insurance. Do I still need renter’s insurance?

Your living community probably only protects itself, so you will want renter’s insurance to cover your personal property and your liability.

Are my valuable possessions covered when I take them out of my home with me?

Yes. All renter’s insurance policies cover your belongings even outside of your home.

Can my renter’s insurance protect high-value items such as artwork and jewelry?

Insurance companies will include a maximum to replace valuable items. If you have items valued higher than a certain amount, we will suggest you purchase additional insurance for individual items. This insurance is called a ‘floater.’

Professional Insurance Strategies is here to answer any questions you might have as you transition into a senior living community. We understand that insurance can be confusing. That is why our team will make sure you are adequately insured and understand what you are paying for.

Check out Professional Insurance Services for more information.

Last month our team traveled to St Louis, MO for a two-day certification event hosted by Moms House. Mom’s House is an organization dedicated to helping seniors and their loved ones receive a fair cash offer on their home as-is with a fast closing date and no stress. The process is meant to help clients get the care they need without the added stress of selling their homes the traditional way.

We received our certification better to serve our senior community and their loved ones when it comes to real estate. We know that this can be a stressful time in their lives, and we aim to offer understanding and accommodating solutions to help.

As a Mom's House certified buyer, we meet the high standards and specific qualifications necessary from Mom's house.

Here are the requirements from the Mom's house program:

We are very excited to be part of the Mom's house program, and we take great pride in offering more sustainable options for our clients that are both honest and fair. If you or a loved one are looking to enter a senior care facility or move in with others, we have many resources available for you.

If you are moving a loved one into a senior care facility, you will probably deal with many questions and obstacles. You may not know how you will afford senior care, who will be responsible for your loved ones existing property, and you may already have debt or medical bills that need to be addressed. Whether you are handling your finances or asking another family member for assistance, it can be stressful trying to figure it all out on your own. Here are some tips to help you cover the cost of senior care living.

If your parents or loved one saved for retirement, then using their savings can be a great way to support their care needs while not having to cover the expenses on your own. Talk to your loved ones about any financial plans they might have prepared for their future.

You might not have known this, but you can use a life insurance policy to pay for care. With this option, you can either use a cash option or sell the life insurance policy as a "life settlement option." Check to see if your loved ones' life insurance policy has a cash value to determine if this option will work for you.

If your loved one owns real estate, you can use these assets to help pay for their care. The typical home selling process does require a lot of paperwork, fees, and the potential of taking at least eight months to sell. If you are in a hurry but still want a fair offer on their home- we can help. Our team is mom's house certified and offers no fuss, no fees, and compassionate solutions to support buying your loved one's home. We understand this is already a stressful process, so we aim to ease your stress, offer you honest solutions, and close on your time.

Not all insurance will cover their stay at a senior care facility, but some can help manage the added medical cost. Medicaid and medicare offer different solutions, but there are some limitations to what they will cover. For instance, Medicaid will help with senior care and home care, but only if you meet specific income requirements. Medicare will not cover long-term stays, but they will help with hospice, or short term stays. Be sure to reach out to your loved ones' insurance provider to see what they can help with.

While finances are only a small part of what you need to know when moving a loved one to senior care, it is one of the biggest concerns you might face. The good news is, there are several ways to pay for care, so take a deep breath and reach out for help from local organizations.

If you need more support on what you need to know through the process, we have other resources that can help!